State of New Mexico

Capitol Buildings Planning Commission

Life Cycle Cost Analysis Application BETA

Capitol Buildings Planning Commission

Life Cycle Cost Analysis Application BETA

Welcome to the

Life Cycle Cost Analysis (LCCA) Tool

New Mexico Capitol Buildings Planning Commission (CBPC)

This Web-based software tool is for State of New Mexico agencies or their employees who are considering a lease-purchase facility acquisition.

Before Using the LCCA ToolIn preparation for using this tool, agencies or their employees should have formulated and sufficiently developed a specific proposal to facilitate a comparative analysis. Before using this tool, at a minimum, users should:

- Complete a facility needs assessment or a facility program documenting agency space requirements; and

- Complete a lease-purchase proposal in cooperation with a developer.

If the agency and its employees want to use this tool, please submit a request for access using the "Request a User Account" button below. A screen dialogue will ask for basic contact information for verification, including the name of the person or agency making the request, position, title and a brief description of the proposed lease-purchase project. CBPC staff will review the request to validate a legitimate need for access to the web tool. Upon approval, staff will email access instructions to the requestor.

Background / Purpose

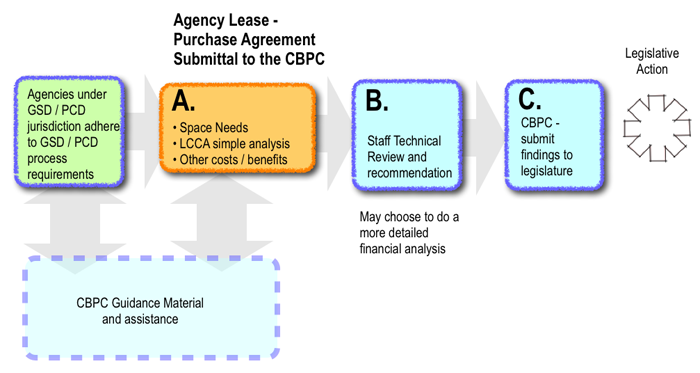

The CBPC is responsible for studying and planning for long-range facilities needs of state government in the metropolitan areas of Las Cruces, Santa Fe and Albuquerque, and after developing an initial master plan for the state facilities in those areas, conduct a review of state properties throughout the state for the development of an overall master plan. The lease-purchase approach to acquisition of state buildings and public schools received approval in 2006 when the citizens of New Mexico passed Constitutional Amendment 2. The legislature assigned to the CBPC the responsibility for reviewing proposed lease-purchase agreements for state buildings. The CBPC recommends to the legislature whether the state should lease, lease-purchase or purchase needed additional facilities.Lease-Purchase Agreement Review Process Overview

The CBPC has developed guidance for agencies to clearly communicate:- Who needs to appear before the Commission for lease-purchase agreement review;

- Which lease-purchase agreements require review;

- The CBPC's lease-purchase agreement review process (see the illustration below); and

- The information to be provided by state agencies that submit lease-purchase agreements.

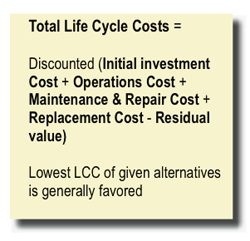

Life-Cycle Cost Analysis

All submittals presented to the CBPC for review must include a LCCA.

LCCA Tool User Input

This LCCA tool offers a simplified life-cycle cost analysis method. Users can develop the analysis by providing basic information such as:- Existing space use data;

- Proposed project name and location;

- Occupancy date;

- Gross square footage (GSF) proposed for new construction;

- GSF and purchase price for an existing building acquisition;

- GSF information about required additions or renovations to a proposed building acquisition; and

- Other identified costs associated with the project.

LCCA Tool Output

The tool's results provide both the user and CBPC staff with a consistent set of comparisons for all lease-purchase proposals. It generates four options for comparison, including:- New state lease or continued existing lease at prevailing local lease rates;

- State construction or purchase of a new facility using cash resources;

- State construction or purchase of a new facility assuming tax-exempt bond financing (with some possible initial cash investment); and

- State lease-purchase of a facility from the private sector (can be new construction or existing), assuming debt financing at private sector rate (Assumptions are established by CBPC staff).

- State lease-purchase of a facility from the private sector (can be new construction or existing), assuming debt financing at private sector rate. (Assumptions are for a proposed lease-purchase transaction, provided by the User.)

If a state agency has a lease-purchase proposal in hand, a fifth option is generated:

Request a User Account